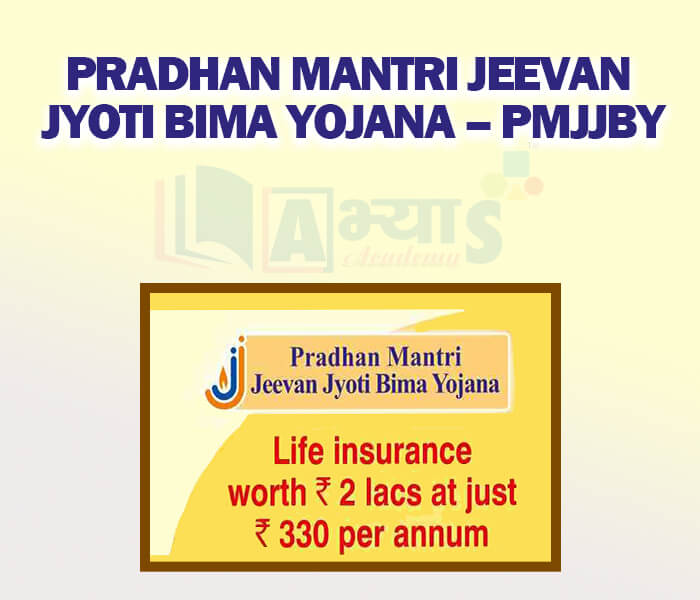

Pradhan Mantri Jeevan Jyoti Bima Yojana - PMJJBY

Pradhan Mantri Jeevan Jyoti Bima Yojana - PMJJBY

PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA : The central government of India has launched a new life insurance scheme, Pradhan Mantri Jeevan Jyoti Bima Yojana for the growth of the poor and low income section of society. As a pure term insurance plan, Pradhan Mantri Jeevan Jyoti Bima Yojana, is available for people between the age group of 18-50 years.PMJJBY is a renewal term insurance policy that, provides a yearly life insurance coverage of Rs.2,00,000 in case of the demise of the insured person, at the most affordable premium rate of Rs.330 per annum.Benefits:

Students / Parents Reviews [10]

It has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thMy experience with Abhyas academy is very good. I did not think that my every subject coming here will be so strong. The main thing is that the online tests had made me learn here more things.

Hiya Gupta

8thMy experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thIt was good as the experience because as we had come here we had been improved in a such envirnment created here.Extra is taught which is beneficial for future.

Eshan Arora

8thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thAbhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.

Om Umang

10thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thOne of the best institutes to develope a child interest in studies.Provides SST and English knowledge also unlike other institutes. Teachers are co operative and friendly online tests andPPT develope practical knowledge also.